If a Government Increases Its Budget Deficit Then Interest Rates

Bonds would pay higher interest and a dollar would. Governments tend to increase borrowing during a recession or low growth.

Solved Show What Will Happen To Supply And Demand In The Chegg Com

There are two primary reasons for this.

. The interest rate would decrease and the real exchange rate would increase. Falls and domestic investment. And net exports both decrease.

How does government affect economy. Government increased its deficit then a. Increases the interest rate so in the market for foreign-currency exchange supply shifts left.

An increase in the government budget surplus or its budget deficit. If the government increased the deficit without the Central Bank buying additional debt then interest rates would increase. The real exchange rate falls and domestic investment rises.

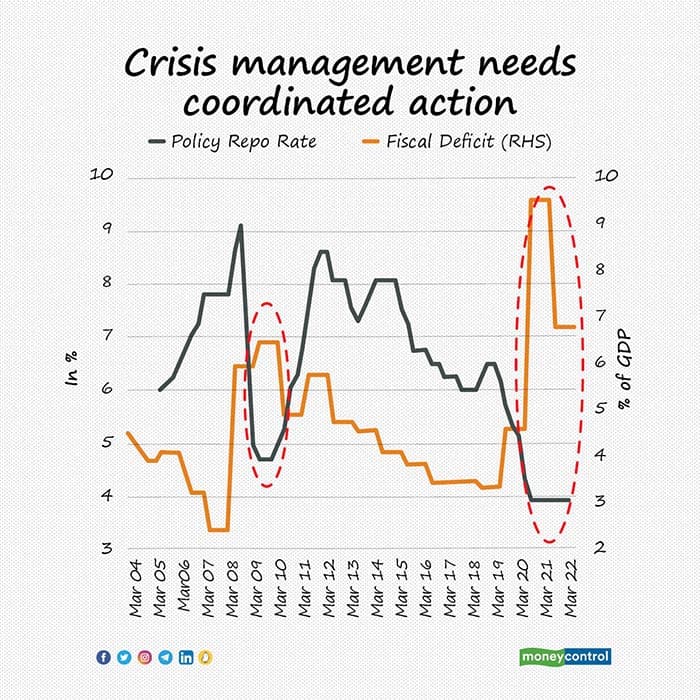

Interest rates are reduced by the central bank buying government debt. Which lowers the interest rate and leads to an increase in total spending. The real exchange rate and domestic investment fall.

If a government increases its budget deficit then the real exchange rate a. Either increase or decrease C. If the government borrows more this can cause interest rates to increase.

But either way increasing budget deficit results in increasing interest rates. A decrease in the money supply results in ___ in the interest rate which leads to a ___ in investment. This is because they will need to increase interest rates in order to attract investors to buy the extra debt.

Government activity affects the economy in four ways. To rise and investment to fall. When the government innovates more and more methods of taxation and resource mobilisation its ability to finance public expenditure increases and the size of public expenditure growsPublic sector outlays could be increased by more taxation yields public debt foreign aid and deficit financing.

And investment to fall. Rises and domestic investment falls. Increases the interest rate so in the market for foreign-currency exchange supply shifts right.

If the government initiates an expansionary monetary policy at the same time that its budget deficit decreases then the interest rate will _____. Rise and the trade balance moves to a deficit. Fall and the trade balance moves to a deficit.

Then the central bank intervenes with string of measures including hike in the interest rate to increase the cost of money and also increase of CRR to soak up the extra money pumped in earlier to boost the market. And investment to rise. If the government of a country with a zero trade balances increases its budget deficit then interest rates.

Rise and the trade balance moves to a surplus. Fall and the trade balance moves to a surplus. A rise in the government budget deficit a.

Bonds would pay higher interest but a dollar would purchase fewer foreign goodsb. Decreases the interest rate so in the market for foreign-currency exchange supply shifts left. And domestic investment rise.

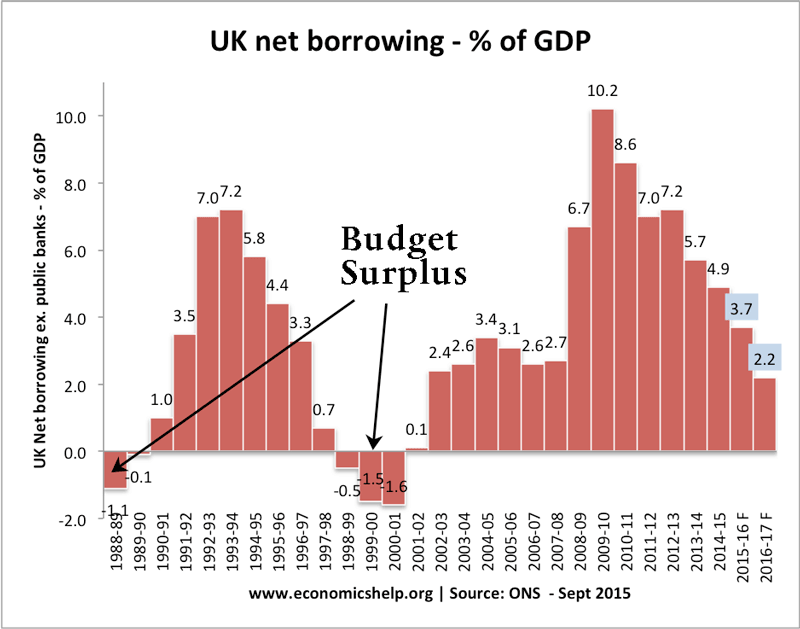

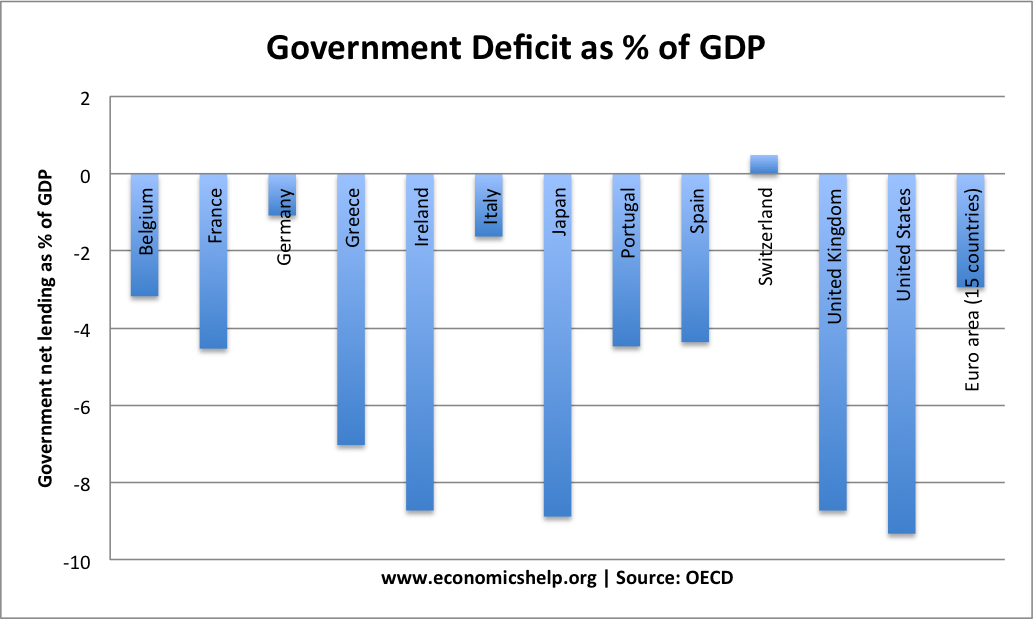

When a country s government budget deficit increases a. In 2012 countries in the Eurozone saw a rise in bond yields because there was a lack of confidence in Eurozone economies and the ability to finance the deficit. Budget surplus Interest rate Exchange rate MSC.

To fall and investment to rise. If a government increases its budget deficit then the real exchange rate a. When the interest rate in an economy decreases it is most likely as a result of.

When the government increases spending and taxes by the same amount output will go up by that same amountWhat happens to interest rates. The government produces goods and services including roads and national defense. What would happen if the government increases spending and taxes by equal amountsThe balanced-budget multiplier is equal to 1 and can be summarized as follows.

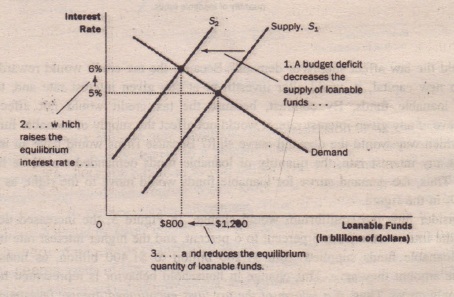

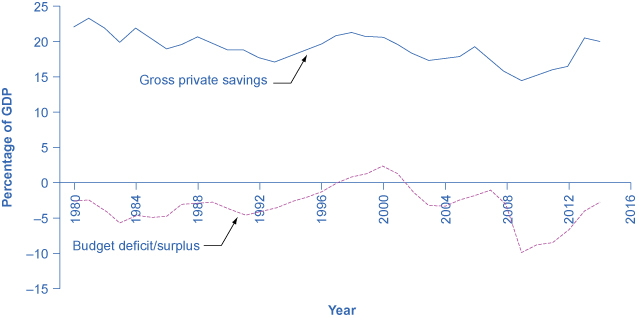

This means there is surplus saving and the government can sell more debt without causing higher interest rates. The real exchange rate and domestic investment rise. If a government increases its budget deficit then the supply of loanable funds.

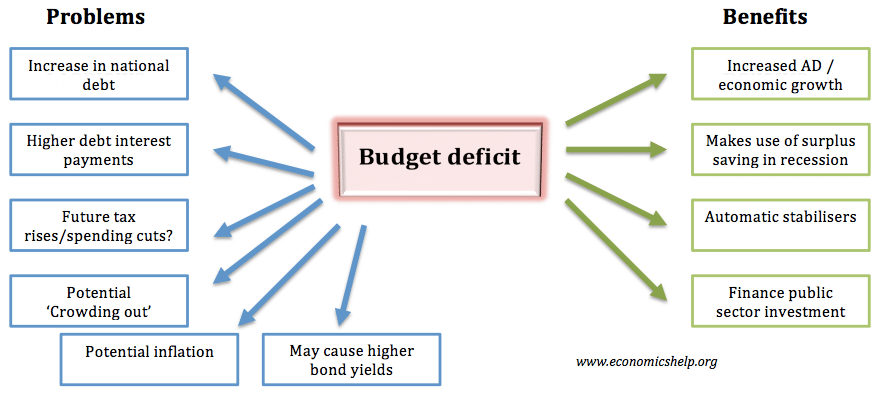

The real exchange rate rises and domestic investment falls. If a government increases its budget deficit which statement would best predict the effects. In the real world the link between a governments budget deficit and interest rates are often quite weak and it can be inverse.

The real exchange rate of its currency and its net exports increase. 15 When a government increases its budget deficit then that countrys a supply of from ECW 1102 at Monash University. An increase in the budget deficit causes domestic interest rates a.

Why does government spending increase. Falls and domestic investment rises. And domestic investment fall.

Poucv 3 Government Budget Deficits And Surpluses Economics Assignment Help Economics Homework Economics Project Help

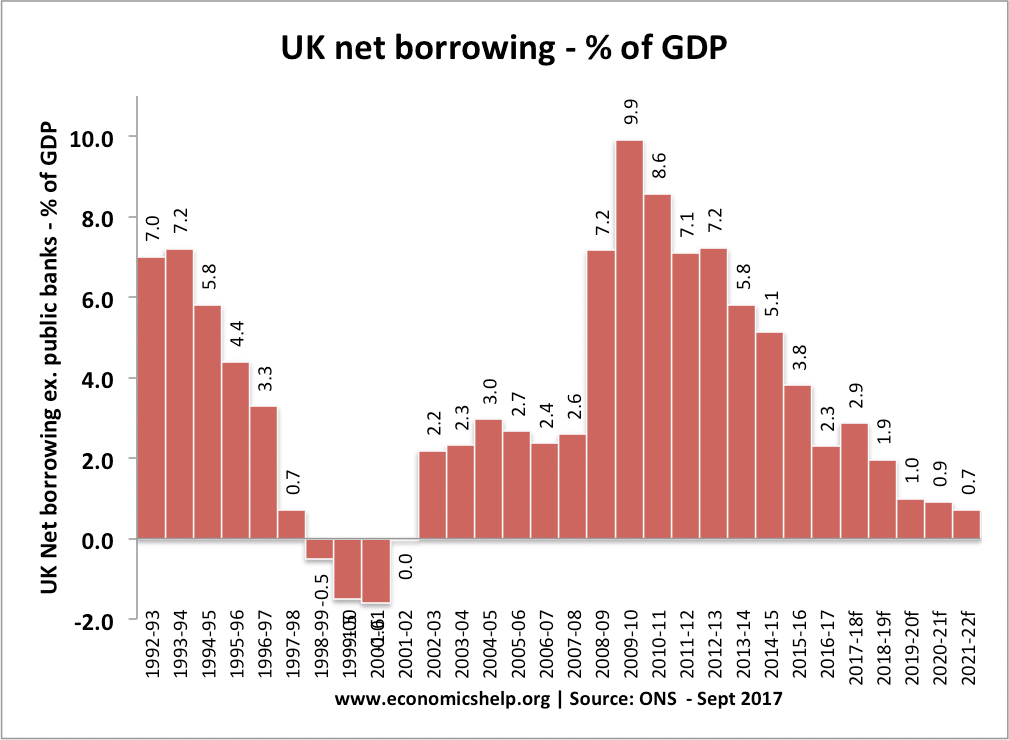

How Important Is The Budget Deficit Economics Help

31 3 How Government Borrowing Affects Private Saving Principles Of Economics

Budget 2022 How Does The Government S Budget Impact Fiscal Deficit And The Value Of Financial Assets

The Market For Loanable Funds Ifioque

The U S Deficit Hit 984 Billion In 2019 Soaring During Trump Era The Washington Post

Economic Effects Of A Budget Deficit Economics Help

Solved Show What Will Happen To Supply And Demand In The Chegg Com

National Income Accounts National Saving The Total Income In The Economy That Remains After Paying For The Consumption And Government Purchases Ppt Download

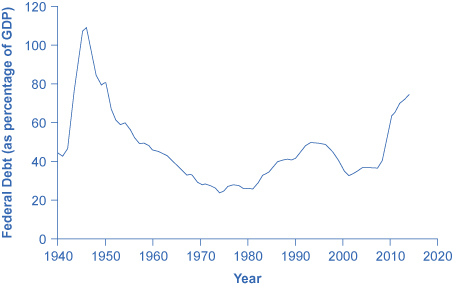

Federal Deficits And The National Debt Principles Of Economics 2e

Solved Show What Will Happen To Supply And Demand In The Chegg Com

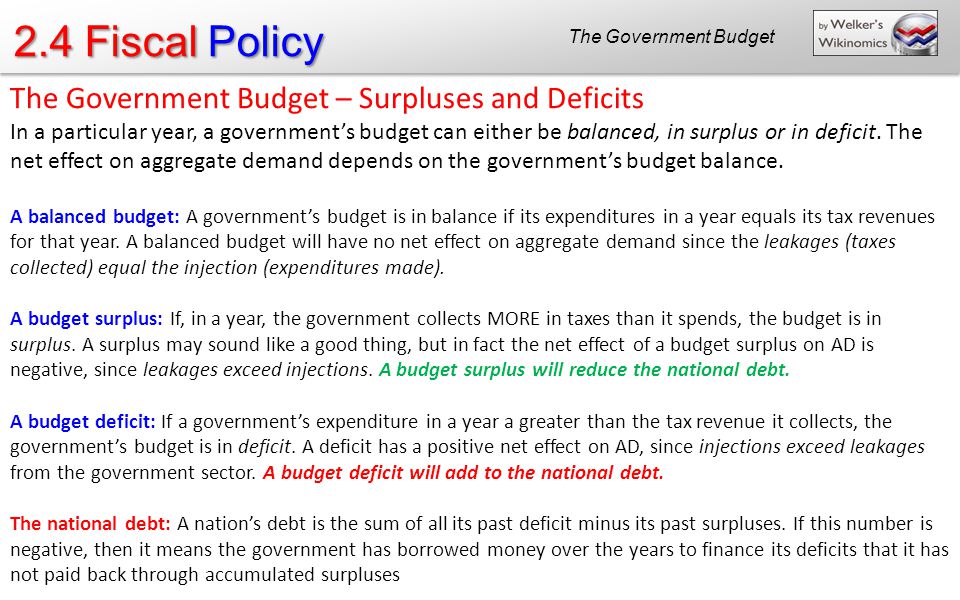

2 4 Fiscal Policy The Government Budget The Role Of Fiscal Policy Ppt Download

Principles Of Macroeconomics 2e The Impacts Of Government Borrowing Fiscal Policy Investment And Economic Growth Oer Repository Affordable Learning Louisiana

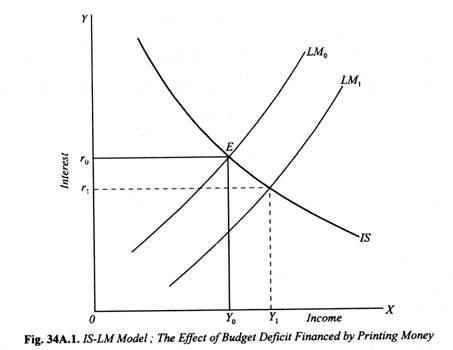

Financing Of Budget Deficit Through Printing Money

Pdf Government Budget Balance And Economic Growth

Policies To Reduce A Budget Deficit Economics Help

Fiscal Policy And The Trade Balance Openstax Macroeconomics 2e

Comments

Post a Comment